Introduction

As the crypto landscape continues to evolve, understanding the patterns and cycles governing this market becomes essential for both new and experienced investors. According to CryptoTracker 2025, the volatility in crypto markets led to a staggering $4.1 billion lost to DeFi hacks in 2024, illustrating the need for comprehensive knowledge about market cycles. With the rapid adoption of blockchain technologies, particularly in emerging markets like Vietnam, where the user growth rate reached 35% last year, grasping the nuances of crypto market cycles is not just beneficial but essential.

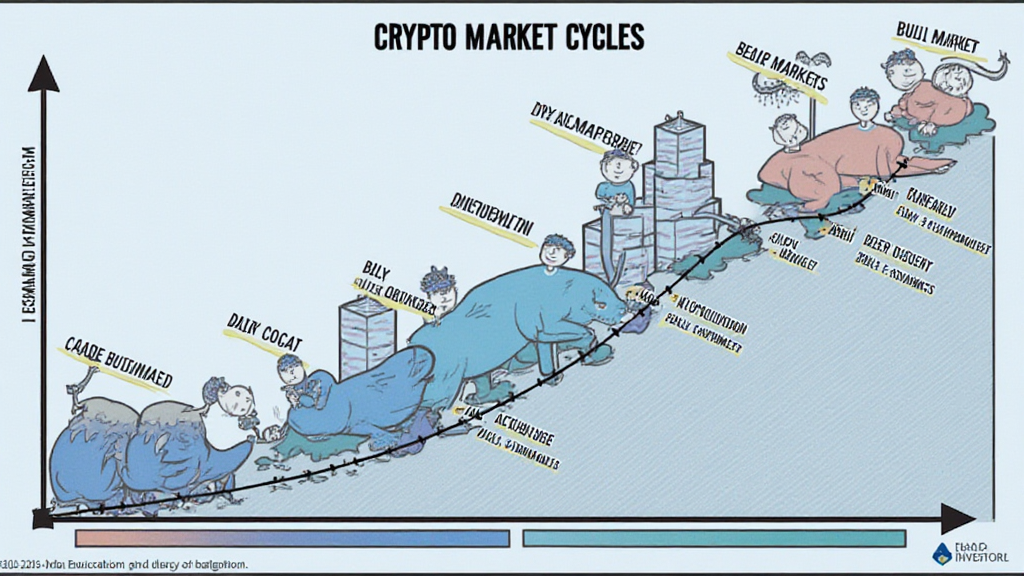

The Basics of Crypto Market Cycles

Crypto market cycles are periods of rising and falling prices typically influenced by a range of factors, including investor sentiment, technological advancements, regulatory news, and macroeconomic conditions. Understanding these cycles can give investors an edge when it comes to making informed decisions about when to buy or sell their assets.

- **Bull Markets**: Characterized by rising prices and increased investor optimism.

- **Bear Markets**: Marked by declining prices and widespread fear or uncertainty among investors.

- **Accumulation Phases**: Periods where prices stabilize and savvy investors accumulate assets for future growth.

- **Distribution Phases**: The point when investors begin selling off their holdings to realize profits.

Identifying Market Phases

A vital part of navigating the crypto market involves recognizing the different phases within a market cycle. Each phase can be identified by various indicators:

- **Economic Indicators**: Data such as GDP growth, unemployment rates, and inflation can offer insights on market sentiment.

- **Technical Analysis**: Chart patterns, moving averages, and support/resistance levels can be used to make predictions based on historical data.

- **Sentiment Analysis**: Tracking social media trends or forums like Reddit can provide hints about general market sentiment.

In Vietnam, as the crypto community grows, platforms such as hibt.com have become beneficial for investors looking to analyze sentiment and make data-driven decisions.

Key Factors Influencing Market Cycles

Recognizing the key drivers behind crypto market cycles is crucial for effectively trading in this volatile environment. Here are some essential factors:

- **Regulations**: Government restrictions or endorsements greatly affect investor confidence.

- **Technological Advances**: Innovations such as Ethereum 2.0 and Layer-2 solutions can create new trends.

- **Market Sentiment**: General feelings and attitudes toward the market can dictate price movements.

The Role of Emotional Psychology

Market psychology plays a significant role in the formation of cycles. Investors often react emotionally, which can lead to sudden market shifts. For instance, during a bull market, greed may drive prices higher, while fear tends to dominate in bear markets. Understanding these psychological dynamics can help investors make more rational decisions rather than emotional ones.

Strategies for Navigating Market Cycles

Smart investors employ various strategies to navigate through the ups and downs of crypto cycles. Here are some effective ones:

- **Dollar-Cost Averaging**: Regularly investing a fixed amount helps mitigate the impacts of volatility.

- **Research & Due Diligence**: Always stay informed about fundamental and technical factors affecting the crypto landscape.

- **Setting Goals**: Define your investment goals and stick to them to avoid being swayed by market emotions.

- **Risk Management**: Establish stop-loss levels to protect against significant losses.

The Future of Crypto Market Cycles

As blockchain technology matures and more institutional investors enter the market, we can expect crypto cycles to evolve. Projections indicate that by 2025, we might witness different cycle lengths and intensities, largely driven by global economic changes and advancements in blockchain technology. Moreover, growth in Vietnam’s crypto user base will likely contribute to a more vibrant trading environment, offering both opportunities and challenges.

Conclusion

Understanding crypto market cycles is paramount for investors seeking to thrive in this dynamic space. By leveraging market analysis tools, staying informed about trends, and adhering to disciplined trading strategies, investors can navigate the complexities of the crypto market with greater certainty. As we move toward 2025, keep a close eye on emerging markets like Vietnam and the ongoing developments within the cryptocurrency realm.

Remember, investing in crypto carries risks. Always conduct thorough research and consult local regulators for financial guidance tailored to your situation.

For more insights into the crypto market, visit thewoodcoin, your trusted source for all things crypto.