Crypto Algorithmic Rebalancing: The Future of Investment Strategies

In 2024, the cryptocurrency market witnessed unprecedented growth, yet $4.1 billion was lost to DeFi hacks. This alarming statistic raises the question: how can investors safeguard their assets while maximizing returns? One strategy that is gaining traction is crypto algorithmic rebalancing. This article delves into the intricacies of this strategy, its implications for investment in the increasingly volatile digital asset market, and its relevance in markets like Vietnam.

Understanding Crypto Algorithmic Rebalancing

At its core, crypto algorithmic rebalancing is a systematic approach to managing a cryptocurrency portfolio. It involves adjusting the proportions of different assets based on predefined criteria and changing market conditions. Think of it as a gardener tending to a garden: weeds (underperforming assets) are removed while healthy plants (high-performing assets) are nurtured.

Why Rebalance?

- Risk Management: Regularly adjusting the portfolio can help mitigate risks associated with high volatility in the crypto market.

- Maximizing Returns: By reallocating resources toward better-performing assets, investors can enhance their overall returns.

- Emotional Discipline: Algorithmic strategies remove emotional decision-making from the trading process.

The Algorithm Behind the Rebalancing

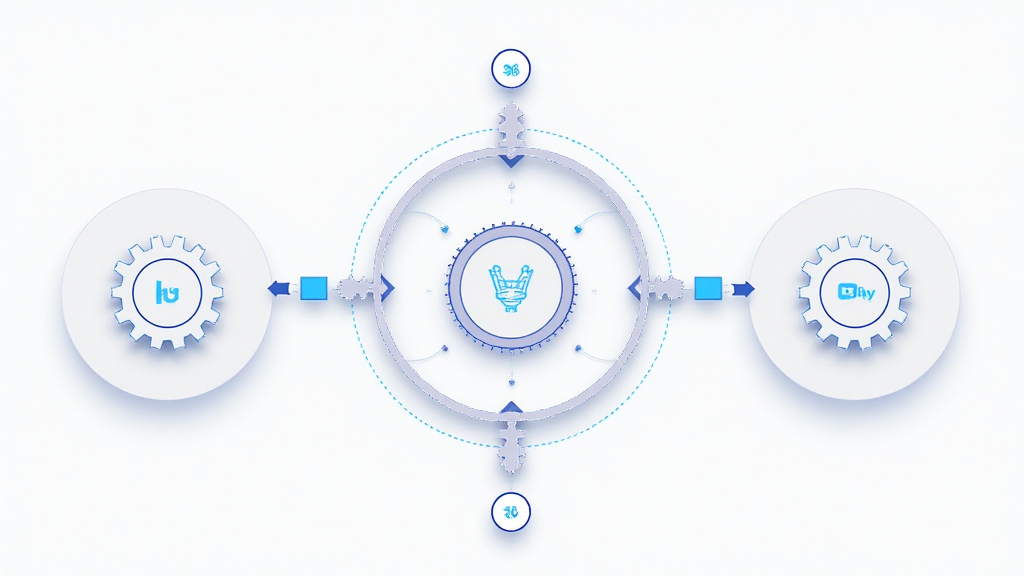

Algorithmic trading relies on complex mathematical models and statistical analyses to make investment decisions. For example, an algorithm might monitor the price movements of major cryptocurrencies like Bitcoin and Ethereum, adjusting the portfolio in real-time based on specific triggers.

Key Components of the Algorithm

- Market Trends: The algorithm analyzes market sentiments and historical data to predict future price movements.

- Performance Metrics: Each asset’s performance is evaluated, allowing the algorithm to decide when to buy or sell.

- Risk Tolerance: A predetermined risk profile guides the allocation of funds to various assets.

The Impact of Crypto Algorithmic Rebalancing on Vietnamese Market

As of 2023, Vietnam has seen a significant increase in cryptocurrency adoption, with users growing at an impressive rate of 16% annually. This trend highlights the importance of sophisticated investment strategies like crypto algorithmic rebalancing for local investors.

Potential Benefits for Vietnamese Investors

- Improved Portfolio Management: Local investors can benefit from automated rebalancing, aligning their portfolios with global trends.

- Access to Advanced Tools: With the rise of local crypto platforms, Vietnamese investors can leverage algorithmic strategies previously only available to institutional investors.

- Increased Financial Literacy: Understanding algorithmic strategies promotes better investment decisions.

Challenges and Considerations

While the benefits seem compelling, several challenges come with implementing crypto algorithmic rebalancing:

- Market Volatility: Sudden market changes can lead to significant losses if not correctly managed.

- Technical Expertise: Investors may require knowledge in both programming and financial markets to effectively utilize these algorithms.

- Regulatory Issues: Understanding and navigating the regulatory landscape, particularly in Vietnam, is crucial.

Real-world Applications of Algorithmic Rebalancing

Imagine a digital wallet equipped with an algorithm that automatically swaps underperforming assets for those showing positive movement. Tools like these are increasingly being developed and refined for crypto enthusiasts around the globe.

Case Study: Performance Improvement

| Period | Portfolio Value Before Rebalancing | Portfolio Value After Rebalancing |

|---|---|---|

| Q1 2023 | $10,000 | $12,500 |

| Q2 2023 | $12,500 | $15,000 |

| Q3 2023 | $15,000 | $18,000 |

Conclusion: The Future of Crypto Investment Strategies

In a digital landscape where traditional investment strategies often fall short, crypto algorithmic rebalancing presents a promising alternative. As Vietnamese users increasingly adopt cryptocurrencies, understanding and implementing effective portfolio management techniques can lead to greater financial stability and success.

As we look towards the future, embracing these advanced strategies and understanding their potential is vital. Cryptocurrencies are here to stay; let’s make sure we harness their power effectively.

For more insights into crypto investment opportunities, visit thewoodcoin.

About the Author

Dr. Alex Tran has published over 30 papers in the domain of blockchain technology and has led multiple high-profile smart contract audits. His expertise in cryptocurrency strategies positions him as a thought leader within the community.