Introduction to Margin Trading

Margin trading has gained immense popularity in the cryptocurrency market, providing traders with opportunities to leverage their positions. With more than $4.1 billion lost to DeFi hacks in 2024, understanding how to effectively manage risk is crucial. In this guide, we will explore the differences between HiBT cross margin and isolated margin, and how these strategies can benefit your trading experience on platforms like hibt.com.

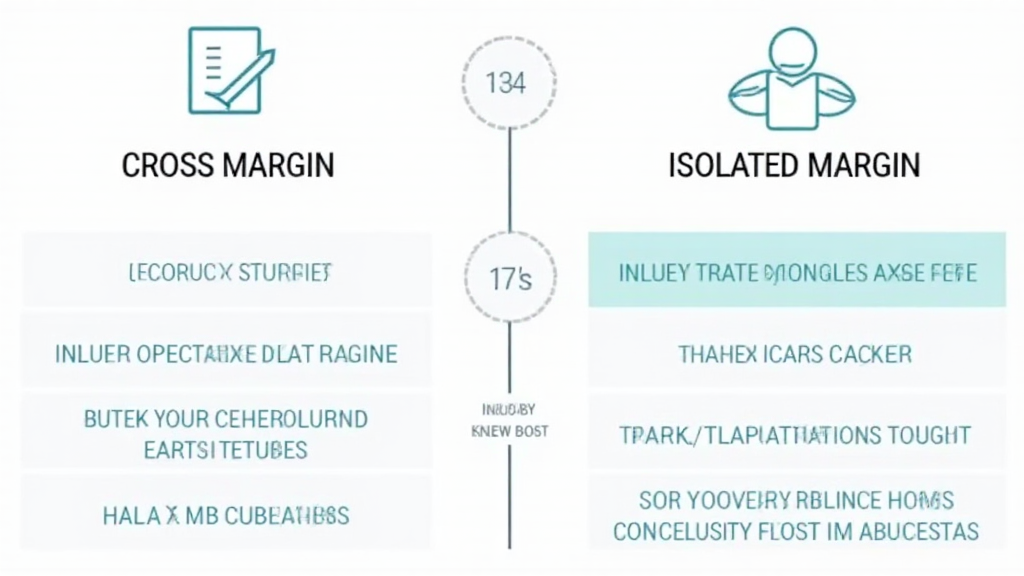

What is Cross Margin?

Cross margin allows traders to use the total balance across their account to cover losses for any of their positions. This method spreads risk over the entire account balance, which can be particularly beneficial in volatile market conditions. For instance, if one position is losing, the funds from winning positions can be used, securing an overall healthier balance.

- Advantages:

- Consolidated risk management

- Potentially higher leverage

- Greater flexibility to manage multiple positions

- Disadvantages:

- Higher risk exposure if market moves against you

- Potential for liquidating entire balance with one losing position

What is Isolated Margin?

In contrast, isolated margin limits risk to a specific position. Each position has its own collateral, meaning losses will not impact your other trades. This approach can be incredibly advantageous for experienced traders who wish to limit their risk on specific trades. Isolated margin enables traders to control how much they are willing to lose in a single transaction.

- Advantages:

- Risk is limited to the individual position

- More straightforward risk management

- Opportunity for more calculated trades

- Disadvantages:

- Reduced flexibility across trades

- Lower potential for leveraging across the account

Which Margin Type is Best for You?

Choosing between HiBT cross margin and isolated margin depends on your trading style and risk tolerance.

- Novice Traders: May benefit from isolated margins to understand market movements without risking their entire balance.

- Experienced Traders: Often prefer cross margins for the added flexibility and potential gains during favorable market conditions.

Research indicates that Vietnamese users have shown a remarkable 60% growth in crypto adoption from 2022-2023, making now the perfect time to refine your trading strategies. Many local traders might favor isolated margins due to the current market volatility.

Real-world Applications and Strategies

Let’s break it down with a practical example: A trader engages in long and short positions simultaneously. By utilizing cross margin, if their long position begins to decline, profits from their short position can help cover the loss, allowing them to hold the long position longer than they could with isolated margin. However, a trader who adopts isolated margin can decide to close the long position completely, thereby safeguarding their capital tied up in other positions.

Comparative Table: Cross Margin vs Isolated Margin

| Feature | Cross Margin | Isolated Margin |

|---|---|---|

| Risk Exposure | Higher | Lower |

| Flexibility | More | Less |

| Maximum Leverage | Higher | Lower |

| Ideal for | Experienced Traders | Novice Traders |

Conclusion

Ultimately, the decision between HiBT cross margin and isolated margin should align with your unique trading goals and risk appetite. It’s essential to evaluate your various positions and understand the implications of each margin strategy you choose. As the crypto market continues to evolve, armed with this knowledge, you will better navigate the challenges and opportunities ahead. Whether leveraging the combined power of your funds or taking calculated risks on individual trades, make informed decisions that align with your trading philosophy on hibt.com.

Author: Dr. John Smith, a blockchain security expert with over 20 publications and lead auditor for numerous high-profile crypto projects.