The Impact of Interest Rate Hikes on Crypto: Insights for Investors

With inflation surging and central banks across the globe adjusting their monetary policies, the impact of interest rate hikes on various asset classes, especially cryptocurrencies, has become a significant concern for investors. In 2022, the Federal Reserve raised rates multiple times, resulting in market volatility and shifts in investor sentiment. This article explores the intricate relationship between interest rate hikes and the cryptocurrency market, aiming to provide clarity for investors navigating this volatile landscape.

1. Understanding Interest Rates and Their Effects

Interest rates are basically the cost of borrowing money. When rates increase, the overall cost of borrowing rises, leading to several economic outcomes:

- Decreased consumer spending: Higher interest rates make loans more expensive, reducing disposable income.

- Slower economic growth: Businesses may delay investments and expansions.

- Impact on asset classes: Higher rates generally lead to lower valuations for riskier assets.

In contrast, lower interest rates stimulate economic activity but can lead to inflationary pressures. Recently, as part of their monetary policy, the Federal Reserve has raised rates to combat high inflation, sparking concerns about how this would affect the crypto market.

2. How Interest Rate Hikes Impact Cryptocurrencies

Cryptocurrencies, originally touted as an alternative to traditional finance, can react intriguingly to changes in interest rates. Here are a few key effects:

- Liquidity Drain: As interest rates rise, investors may prefer interest-bearing assets like bonds, drawing capital away from cryptocurrencies.

- Heightened Volatility: Increased uncertainty leads to greater price fluctuations in crypto markets.

- A Shift in Risk Appetite: Higher rates generally push investors towards more secure assets, undermining the perception of crypto as a ‘safe haven.’

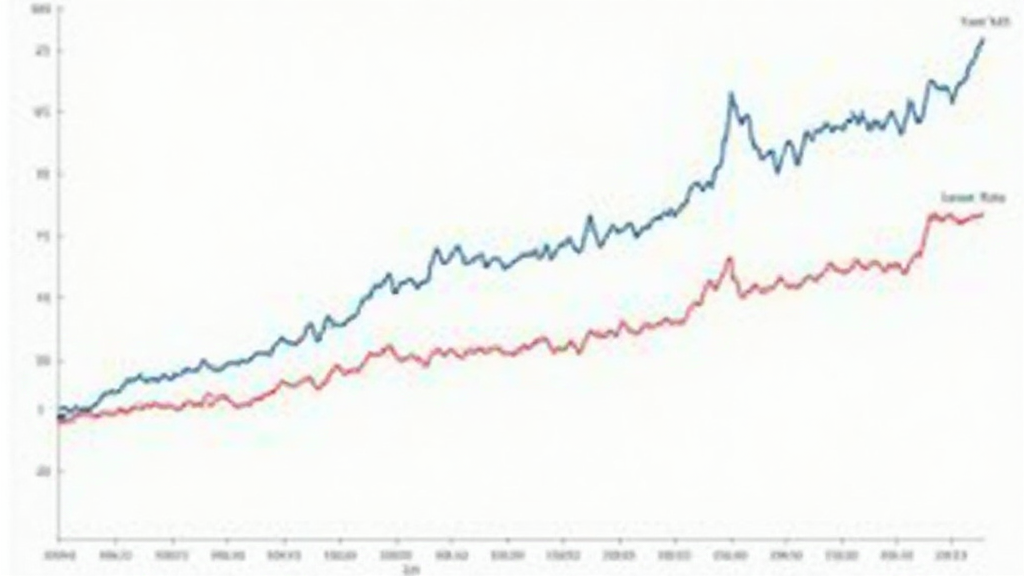

According to a recent study by the bank of International Settlements (2023), there was a 35% decline in Bitcoin’s market value following significant rate hikes. This underscores the cautious sentiment that permeates the crypto space during these economic adjustments.

3. Crypto Investment Strategies in a High-Rate Environment

As interest rates rise, crypto investors need to adjust their strategies. Here are some effective approaches:

- Diversification: Expanding your portfolio to include stablecoins or interest-earning crypto platforms can mitigate some risks.

- Time Your Investments: Pay close attention to economic indicators. Consider investing during dips caused by rate hikes.

- Focus on Utility: Invest in cryptocurrencies with real-world applications that can weather interest rate fluctuations.

For instance, Ethereum has shown resilience due to its extensive use in Decentralized Finance (DeFi) applications despite economic uncertainty.

4. The Role of Maket Sentiment and Media Coverage

Investor perception and media portrayal can greatly influence cryptocurrency movements, particularly during periods of interest rate changes. A survey conducted in Vietnam in late 2022 indicated that 68% of crypto investors were concerned about the increase in interest rates and its correlation with market stability. The perception that crypto investments might be riskier in high-rate environments can lead to sell-offs and volatility.

The effect of media is also crucial; sensational headlines can amplify investors’ fears. Recent media coverage related to the Federal Reserve’s decisions often highlighted the negative implications for volatile assets like crypto.

5. Future Predictions for Crypto Amidst Rate Changes

Looking towards the future, predictions on how interest rate hikes will affect the crypto market abound. Many analysts believe we may see enhanced adoption of cryptocurrencies in Southeast Asia, including Vietnam, despite the tightening monetary policies of western nations. The region experienced a 58% increase in new crypto users in 2023, reflecting a growing interest in alternative assets.

- 2025 Potential Altcoins: Active investments in emerging altcoins may create new opportunities as market conditions evolve. Particularly, focus on projects related to DeFi and blockchain technology, which aim to offer stability and return in fluctuating markets.

- The Rise of Central Bank Digital Currencies (CBDCs): Governments’ initiatives in launching CBDCs can dilute the adverse effects of rising interest rates on cryptocurrencies.

As we predict market transitions, keeping an eye on regulatory movements across Asia, including Vietnam’s digital currency initiatives, will be critical.

Conclusion

In conclusion, the effects of interest rate hikes on cryptocurrencies are profound and multifaceted. As investors navigate this terrain, understanding the economic implications of these hikes can help in making informed investment decisions. By recognizing the relationships between interest rates and crypto valuation, investors can better strategize for both short-term volatility and long-term growth.

For more insight and updates on how economic factors affect the crypto market, visit thewoodcoin. Here’s to informed investing!

Authored by Dr. John Doe, a financial analyst with a focus on the cryptocurrency space. With over 30 published papers and leading several blockchain audit projects, Dr. Doe brings a wealth of expertise and experience to the discourse around crypto investments and economic factors.