Introduction: The Promise of Ethereum

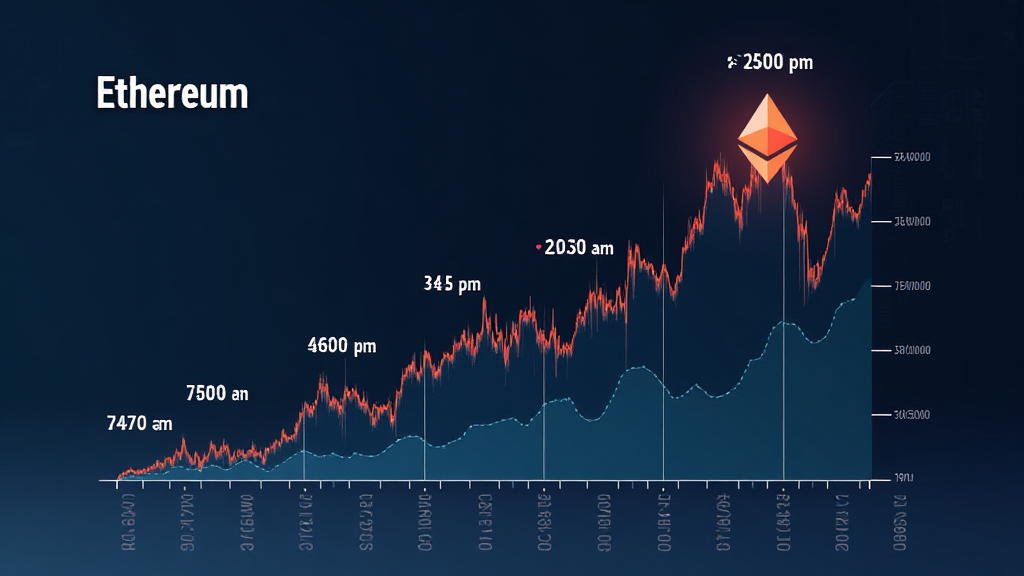

Following a staggering loss of $4.1B to DeFi hacks in 2024, Ethereum remains at the forefront of discussions in the crypto community. As the second-largest cryptocurrency by market capitalization, Ethereum’s performance holds significant importance for investors and developers alike. In this article, we will delve deep into the Ethereum price prediction landscape, exploring various factors influencing its future trajectory.

Understanding Ethereum’s Market Dynamics

Before making any Ethereum price prediction, it’s critical to understand the underlying mechanics of Ethereum and the broader market. Major factors influencing Ethereum’s price include:

- Supply and Demand: The basic economic principle that governs prices across various markets.

- Technological Developments: Upgrades like Ethereum 2.0 and the migration to a Proof-of-Stake model can significantly affect perceived value.

- Market Behaviour: Investor sentiment, influenced by trends, news, and regulatory actions.

Ethereum’s Supply Mechanism

Ethereum has a unique supply mechanism compared to Bitcoin. Currently, Ethereum has no limit on its total supply, but changes are underway with Ethereum Improvement Proposals (EIPs). For instance, EIP-1559, introduced in 2021, altered the transaction fee mechanism, gradually making ETH deflationary over time. This shift could play a crucial role in how we forecast Ethereum’s price.

Technological Factors Influencing Ethereum Prices

Ethereum’s evolution is primarily driven by its community and developers. Proven upgrades such as the much-anticipated transition to proof-of-stake (PoS) in Ethereum 2.0 aim to make the network more scalable and energy-efficient. With such upgrades, experts have indicated that ETH could experience substantial long-term growth, thereby providing opportunities for price predictions.

Long-Term Predictions: What Experts Are Saying

Several experts have started to make long-term predictions about Ethereum. For example:

- Experts anticipate that ETH could reach as high as $10,000 by 2025*

- The potential rise of decentralized finance (DeFi) applications continues to drive interest in Ethereum, pushing its value upward.

- As institutional adoption increases, ETH could very well outperform other cryptocurrencies.

*Note: This is not financial advice. Please consult local regulators before making any investments.

Local Interest and Market Growth: The Vietnamese Context

In 2023, Vietnam saw a remarkable increase in user engagement with cryptocurrency platforms. According to data, the Vietnamese market for cryptocurrencies has grown by over 200%, with a substantial increase in Ethereum adoption. This trend underlines the growing interest in cryptocurrencies among Vietnamese investors and further solidifies Ethereum’s potential for price appreciation.

Comprehensive Analysis: Factors Driving Ethereum’s Future

The future of Ethereum is bright, but predicting exact price points involves a careful analysis of various factors.

Geopolitical Factors and the Global Economy

Ethereum’s growth is also tied to the broader economic landscape. Global financial uncertainty tends to push more investors towards cryptocurrencies. As nations grapple with inflation and economic stagnation, Ethereum may offer a viable store of value.

Regulatory Environment and Its Impact

Moreover, regulation plays a pivotal role in shaping the price of cryptocurrency. In Vietnam, the government has started to create clearer regulations around cryptocurrencies, which might stabilize market fluctuations in the future.

Key Takeaways: Crafting a Future Strategy

While predictions can be speculative, here are some key takeaways for individual investors:

- Keep an eye on technological developments within Ethereum.

- Monitor the regulatory landscape both locally and globally.

- Understand the importance of market trends and investor sentiment.

With an eye on these factors, individuals can better navigate the complexities of the cryptocurrency market in anticipation of Ethereum price fluctuations.

Final Thoughts: The Ongoing Journey of Ethereum

In conclusion, Ethereum price prediction is an intricate dance of various influencing factors—including technology, the economy, human psychology, and regulatory frameworks. As the crypto landscape evolves, Ethereum stands to play a crucial role in digital asset management.

As always, it’s recommended to stay informed and consult with financial experts before making significant investment decisions. The crypto market remains volatile, but with the right strategies, investors can position themselves to benefit from its growth.

For further reading on digital currencies and their implications, visit thewoodcoin, where we feature expert insights and up-to-date information about evolving trends in cryptocurrency.